4 Easy Facts About Palau Chamber Of Commerce Shown

Wiki Article

Palau Chamber Of Commerce Things To Know Before You Buy

Table of ContentsPalau Chamber Of Commerce - An OverviewThe Definitive Guide to Palau Chamber Of CommerceEverything about Palau Chamber Of CommerceOur Palau Chamber Of Commerce IdeasExamine This Report about Palau Chamber Of CommerceThe Best Strategy To Use For Palau Chamber Of CommerceExcitement About Palau Chamber Of CommerceHow Palau Chamber Of Commerce can Save You Time, Stress, and Money.

For more information, have a look at our post that talks even more comprehensive concerning the main nonprofit funding resources. 9. 7 Crowdfunding Crowdfunding has actually come to be one of the vital ways to fundraise in 2021. Therefore, nonprofit crowdfunding is grabbing the eyeballs these days. It can be utilized for certain programs within the organization or a basic contribution to the cause.Throughout this action, you may intend to consider landmarks that will indicate a chance to scale your not-for-profit. When you've run for a little bit, it's essential to take some time to think of concrete growth objectives. If you have not currently produced them throughout your preparation, develop a set of vital efficiency signs as well as milestones for your nonprofit.

7 Easy Facts About Palau Chamber Of Commerce Shown

Without them, it will certainly be hard to examine as well as track progression later as you will certainly have absolutely nothing to measure your outcomes versus and also you won't understand what 'effective' is to your nonprofit. Resources on Beginning a Nonprofit in various states in the United States: Beginning a Nonprofit Frequently Asked Questions 1. How much does it set you back to begin a not-for-profit company? You can start a not-for-profit organization with a financial investment of $750 at a bare minimum and also it can go as high as $2000.

What Does Palau Chamber Of Commerce Mean?

With the 1023-EZ form, the processing time is generally 2-3 weeks. Can you be an LLC as well as a not-for-profit? LLC can exist as a not-for-profit restricted obligation firm, however, it must be entirely owned by a single tax-exempt not-for-profit organization.What is the difference in between a foundation and a nonprofit? Foundations are commonly funded by a family or a corporate entity, however nonprofits are funded through their revenues as well as fundraising. Foundations normally take the money they started out with, invest it, and afterwards distribute the money made from those investments.

Facts About Palau Chamber Of Commerce Uncovered

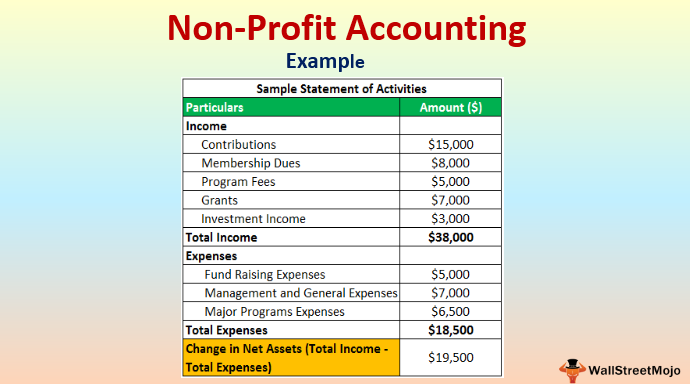

Whereas, the additional cash a not-for-profit makes are used as operating costs to money the organization's goal. Is it hard to start a not-for-profit company?There are numerous actions to begin a nonprofit, the obstacles to entry are fairly couple of. Do nonprofits pay taxes? If your not-for-profit earns any earnings from unconnected activities, it will owe earnings taxes on that amount.

The Ultimate Guide To Palau Chamber Of Commerce

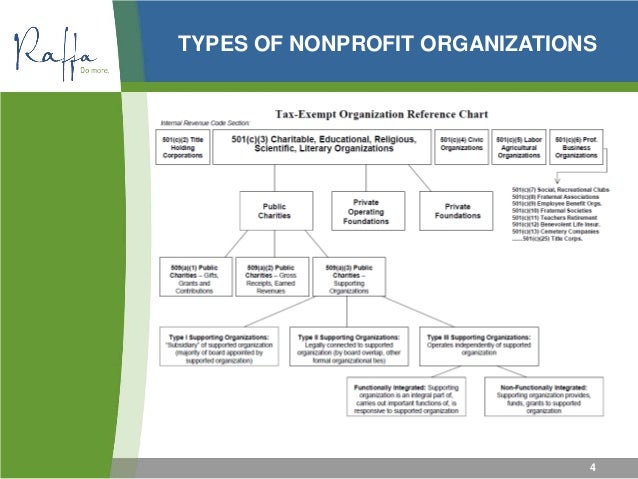

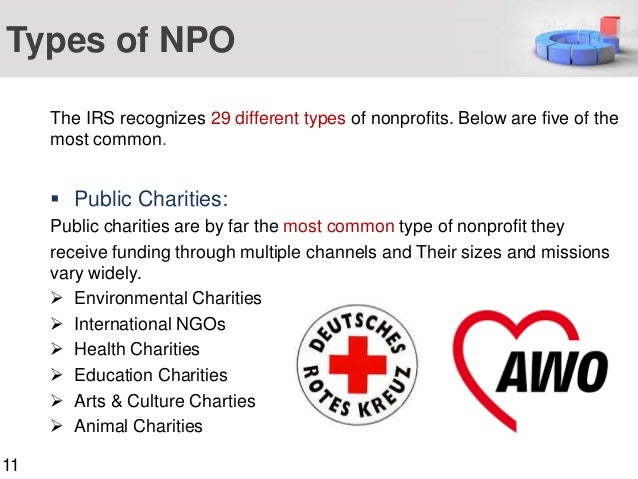

By far the most usual kind of nonprofits are Area 501(c)( 3) companies; (Section 501(c)( 3) is the part of the tax code that authorizes such nonprofits). These are nonprofits whose objective is charitable, religious, educational, or scientific.

The 5-Minute Rule for Palau Chamber Of Commerce

The bottom line is that exclusive structures get a lot worse tax obligation therapy than public charities. The main distinction in between exclusive structures as well as public charities is where they obtain their financial backing. A private structure is generally controlled by an individual, family members, or corporation, as well as acquires a lot of its income from a few donors as well as financial investments-- a fine example is the Costs as well as Melinda Gates Structure.

Palau Chamber Of Commerce Things To Know Before You Buy

Most structures just offer cash to other nonprofits. As a functional matter, you need at least $1 million to start an exclusive structure; otherwise, it's not worth the problem and also cost.Various other this hyperlink nonprofits are not so lucky. The internal revenue service initially Recommended Site presumes that they are exclusive foundations. A new 501(c)( 3) organization will certainly be categorized as a public charity (not a personal structure) when it uses for tax-exempt standing if it can show that it fairly can be expected to be publicly supported.

Little Known Questions About Palau Chamber Of Commerce.

If the IRS categorizes the not-for-profit as a public charity, it maintains this standing for its first five years, no matter the public assistance it actually obtains throughout this time around. Palau Chamber of Commerce. Starting with the nonprofit's 6th tax year, it must show that it meets the general public support test, which is based upon the support it receives during the current year and previous four years.If a not-for-profit passes the examination, the internal revenue service will remain to monitor its public charity status after the initial five years by requiring that a completed Set up A be submitted annually. Palau Chamber of Commerce. Figure out more about your not-for-profit's tax status with Nolo's book, Every Nonprofit's Tax obligation Guide.

Report this wiki page